Here is our latest news from Fairfax Cyprus

Here is our latest news from Fairfax Cyprus

Changes in 2026

FairfaxPayroll wishes to inform all of our clients about the changes that will be put in effect in 2026.

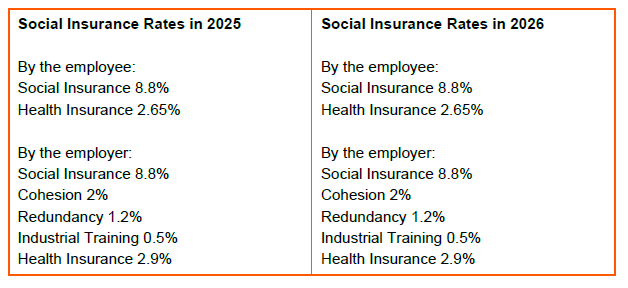

SI Contribution Rates

At the moment, the rate applicable remains at 8.8% deducted by the employee and 8.8% contributed by

the employer.

There is no further change at the contribution rates of the other social insurance funds in effect.

You may refer to the chart below for your ease of reference:

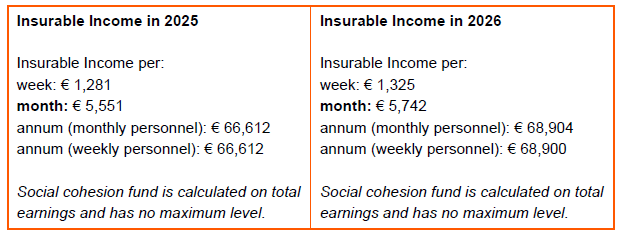

SI Insurable Income Increase

However, the maximum level of yearly insurable earnings will change. During 2025 the yearly maximum

level of insurable income was €66,612, while from 1st January 2026 the maximum level of insurable

income will be increased to €68,904 per annum.

New National Minimum Salary

As of January 1, 2026, a new national minimum salary will apply.

€1,088 per month (gross) for full-time employees who have been with the same employer for at least six

months.

€979 per month (gross) for employees with less than six months’ continuous service.

How can we help?

Explore the benefits of engaging the Fairfax team to assist you by outsourcing your payroll function to us.

Contact our team on +357 25558025 or at accounts@fairfaxpayroll.com

Visit our website www.fairfaxpayroll.com