Here is our latest news from Fairfax Cyprus

Here is our latest news from Fairfax Cyprus

Changes in 2026

FairfaxPayroll wishes to inform all employers about the recent changes to Personal Taxation in

Cyprus, which are applicable from 1 January 2026 onwards.

These changes form part of a wider tax reform aiming to modernise the tax system, provide relief to

individuals and families, and enhance tax compliance.

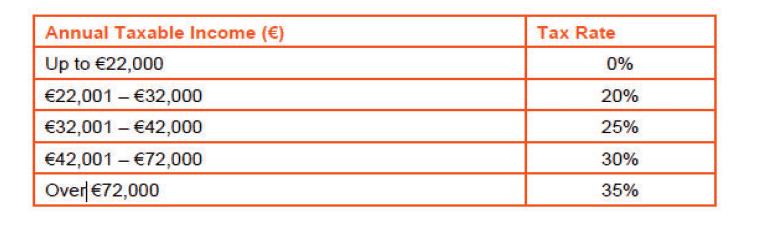

Personal Income Tax Rates (Effective 1 January 2026)

Increase in Tax-Free Threshold

The annual tax-free income threshold has increased from €19,500 to €22,000, reducing the tax burden

for low and middle-income earners.

New Tax Deductions

Additional deductions have been introduced to support households and encourage sustainable living.

Indicatively, the new deductions include:

– Deductions for dependent children and students, subject to income criteria

– Deduction for rent or mortgage interest (up to €2,000 per year)

– Deduction for green investments, including energy-efficient home improvements and electric vehicles

– Deduction for home insurance premiums.

Further details and eligibility criteria will apply.

Mandatory Submission of Tax Returns

From 2026 onwards, all individuals aged 25 and over will be required to submit an annual personal

income tax return, regardless of income level.

How can we help?

Our team can assist you in understanding how these changes affect your personal tax position and help

you plan accordingly.

Contact our team on +357 25558025 or at accounts@fairfaxpayroll.com

Visit our website www.fairfaxpayroll.com